2021年的小家电市场,并未延续以往的热度。

不管是从零售额还是零售价都出现了不同程度的“降温”现象,增速呈放缓态势。

数据显示,2021上半年小家电零售额共计250.8亿元,同比下降8.6%;零售量11911万台,同比下降8.2%。

小熊电器作为小家电赛道的热门玩家,某种程度上反映了行业的整体情况。

自2019年8月上市,小熊电器股价一路飙升至159.4港元/股,但从去年八月份开始,股价便进入了“跌跌不休”的模式。截至发稿前,小熊电器每股报收于64.1港元,相较去年同期已近乎腰斩,整体市值大幅缩水。

小熊电器去年三季报表现也不尽如人意,实际营收23.65亿元,同比下降5.32%,实现归母净利润1.89亿元,同比下降41.29%。

市场遇冷,业绩承压,是许多小家电企业面临的困局。

1、小家电降温原因何在?

第一,需求趋于饱和,消费回归理性。

疫情期间,“宅经济”叠加消费升级需求,激发了消费者对不同场景下小家电的需求。

大部分小家电依靠线上渠道红利,并通过高颜值、高性价比吸引用户购买,消费者开启了“买买买”模式。

随着疫情逐渐控制,一方面居家不再成为消费者的唯一生活场景,宅经济减弱;另一方面,一些被产品高颜值吸引的用户也回归理性,使得小家电需求恢复到正常水平。

第二,高基数压力。

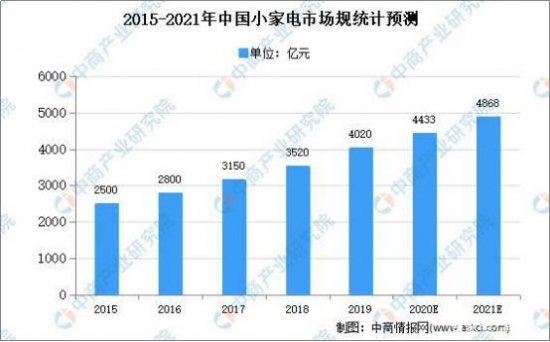

数据显示,2019年我国小家电市场规模达4020亿元,中商产业研究院预测,2021年我国小家电市场规模将达4868亿元。

▲图片来源中商情报网

在高基数下的小家电市场,相比之前的高歌猛进,如今增长略显乏力。

由于铜、铝等原材料价格大幅上涨,各小家电品牌迫于成本压力不得不提高售价,抑制了下游消费需求。

2、小家电品牌寻求新突破

在短期业绩承压的情况下,众多小家电品牌纷纷寻求新突破。

空气炸锅、迷你酸奶机、拖地机器人等一大批脑洞大开的小家电产品频频出现,部分品牌不断开发新品类,希望打造出下一款“爆品”。

还有一些品牌则将视线转向海外市场,借此开辟企业第二增长曲线。

全球小家电市场呈现出蓬勃发展态势,一些企业围绕跨境电商开启出海布局,发展了独立站、亚马逊、eBay等海外渠道。

2020年,以A股新宝股份、小熊电器、科沃斯为代表的头部玩家,在经营业绩上表现出优异战绩:新宝股份靠小家电出海拿下了101.74亿元的营业收入;小熊电器2020年海外营业收入达2.09亿元,同比增长 143.21%;科沃斯2020年境外贡献的营业收入达33.79亿元,占比46.71%。

在国内市场遇冷的境况下,众多小家电企业更是加快出海步伐。

1、家电成出海“长青”品类

国内严防疫情下的稳定生产与境外疫情反复下的制造业动荡,形成产品供应的时间差,给中国制造和品牌出海带来巨大红利,并延续到后疫情时代。

在此因素推动下,大量中国品牌对海外市场更是翘首以盼。

天猫淘宝海外数据显示2020年-2021年10月,天猫淘宝海外的中国品牌数量均保持10%的同比增长速度。

从近三年销量最高的top10品牌榜单看,家电成为出海“长青”品类之一,最受境外消费者青睐。

具体品牌包括小米、美的、海尔、苏泊尔、科沃斯等,他们在海外市场均创造了可观的营收和增速。

国内小家电的出口企业更是开启“爆单”模式,海关数据显示,2021年我国小家电出口增长已超过600%,微波炉连创出口金额纪录;上半年我国电炒锅、面包机、榨汁机等出口分别增长62.9%、34.7%、12.1%。

预计到2025年,小家电在全球范围的销售规模将超过2300亿美元。

▲图片来源海关总署

2、小家电出海动力因素

得益于中国“优质供应链+跨境电商基础设施+高效出海数字营销”的模式,出海赛道上,中国涌现出越来越多具有竞争力的本土品牌。

第一,供应链优势。

现在的中国制造优势不仅体现在廉价劳动力、巨无霸生产模式上,最重要是体现在供应链优势上。

正如亚当斯密在《国富论》所言,通过多人分工合作的产出远比单人负责所有步骤产出来得高,而中国供应链正体现一种现代化、更高级的分工。

这种供应链优势来自于群聚效应。

这种群聚效应主要体现中国的几大典型的产业带上,如顺德小家电产业带、佛山家具家居产业带、曹县汉服产业带、福建运动产业带等。

其中,顺德家电产业目前规模超过3000亿元,拥有生产及配件类企业3000多家,汇聚了美的、格兰仕、万和等一大批行业知名的家电企业。同时顺德还涌现出一批如新宝股份、小熊电器、德尔玛等小家电“新势力”。

这些产业带,基本上满足企业们的一站式需求,让他们想到就能拿到,拿到就能做好,做好就能发货。

第二,跨境电商赋能。

跨境电商绝对是近一两年热门的赛道之一。

2020年跨境电商出口1.12万亿元,同比增长40.1%。天眼查数据显示,2020年上半年,全国新增跨境电商相关企业2356家,其中6月份的单月注册量最高,达到了637家。

一些小家电企业借势跨境电商,为自身赋能。去年7月开始,小天鹅、小熊电器、九阳等企业先后切入跨境电商业务。

第三,高效出海数字营销。

在品牌出海过程中,高效的数字营销能力起着关键性作用。

数字化时代,一方面,品牌们可以借助数字化精准定位目标人群,获取他们的喜欢,并定向推荐相关产品;另一方面,国内外消费者们可以通过社媒发声,让海外消费者进一步了解中国商品。

除此之外,小家电出海之路也少不了政策扶持。

3、小家电出海阻力因素

首先,国际物流运价飙升,时效太慢,成为后疫情时代跨境卖家面临的一大难题。

疫情常态化下,欧美等发达国家需求持续回复,线上购买需求激增,但全球集装箱运力则表现不佳,存在较大的缺口。

根据《跨境物流FBA头程研究报告》显示,不管是从区域市场运价看,还是从物流渠道运价看,海运、空运与铁路FBA头程运价均呈上升趋势。

部分国内品牌表示疫情期间物流成本增长超过五成。

根据雨果跨境关于跨境卖家最为关注的出口物流问题的调查中发现,“价格太高,承担不起”、“时效太慢,经常断货”、“仓库爆仓、上架太慢”成为最困扰他们的三大问题。

其次,来自境外平台的阻力。

去年四月,亚马逊平台政策趋严,针对违反法律法规或平台规则的第三方卖家进行大规模整顿,中小企业相继沦陷。

根据数据统计,中国被亚马逊封号卖家数量超过5万左右,造成行业损失预计千亿,涉及品类包括家电、3C电子产品等。

政策趋严下,小家电出口也将迎来全面洗牌,让一些运营规范且成熟的企业更具优势。

多重阻力下,小家电企业还有哪些机会?

受益于消费升级,小家电作为高品质生活的象征,迅速成为消费热点。

据中商产业研究院数据显示,2019年我国小家电市场规模达4020亿元,预测2021年我国小家电市场规模将达4868亿元。从细分产品销售占比来看,厨卫小家电销售额占76%,家居类小家电占13%,个人护理类占11%。

在海外市场,不同细分场景下同样潜藏着巨大的产品创新机会。

1、品类创新机会

第一,清洁电器

根据meltwater数据显示,2020年12月-2021年11年期间,清洁电器在境外社媒的总提及量达到3680次,北美地区和东南亚地区对清洁类电器的讨论最为热衷。

分析搜索结果词云可以发现,扫地机器人等关键词屡次出现,同时扫地机器人连续三年进入天猫海外销量最高top单品榜单。

资本市场,扫地机器人也备受欢迎,据不完全统计了解,扫地机器人行业至少发生了10起投融资事件,几乎每个月都有玩家获得数千万级融资,包括甲壳虫智能、哇力等。

即便市场上玩家众多,但扫地机器人可挖掘的空间还是相当可观,就渗透率而言,2021年尚不足5%。

此外,在大多数关键清洁小家电类别中,中国的渗透率低于发达国家,以吸尘器为例,中国每100户家庭拥有吸尘器量仅12个,美国和英国每100户家庭拥有吸尘器量超100个,日本和南韩每100户家庭拥有吸尘器量也超90个。

第二,厨房家电

根据meltwater数据显示,过去一年厨房电器在境外社媒的总提及量达到449次,北美、英国、中国香港对厨房类电器的讨论最为热衷。

2020年上半年,家电品类表现活跃,在天猫海外成交量同比增长约70%,成交人数增长一倍。

厨房家电中,传统品类小厨电已经步入饱和初期,只有养生品类(电蒸炖锅、养生壶、空气炸锅等)顶住压力,保持较快增速。

空气炸锅起势最快且最受欢迎,“健康无油”一直是它的卖点。

第三,娱乐家电

娱乐家电也成为出海的新宠,特别是家庭KTV点歌机和投影仪等能够提高幸福感的小家电。

比如说,部分用户将自家客厅打造成一个可以集影音、KTV于一身的娱乐空间。

借助国内强大的供应链能力,使得国内小家电品牌能够针对不同细分场景研发出不同产品,以抓住境外消费者日益变化的需求。

2、解放双手,接轨智能化小家电

在“懒人经济”下,消费者中会做家务或愿意做家务的人越来越少,因此使用便利、舒适度高的小家电愈加受消费者青睐。

“减脂利器”空气炸锅、解放双手的扫地机器人等等智能小家电屡见不鲜、层出不穷。

目前智能家电市场规模较大,基本已成熟,如果深耕细分领域,解决用户痛点,做出性价比高的产品,那么成为爆品的几率会高很多。

随着智能设备的普及(如可穿戴智能设备、智能手机等),使消费者对智能生活的需求和依赖程度越来越高。设计人性化、操作智能化的小家电将成为未来消费的趋势。

3、打造DTC品牌

SHEIN凭借DTC模式席卷全球快时尚市场。

DTC(Direct-to-Consumer)指的是绕过任何第三方零售商、批发商或其他中间商,直接向消费者销售产品。DTC 品牌通常多在网上销售,专注于特定的品类满足用户的细分需求,通过品牌独立站的形式留存消费者,形成了一种电子商务模式。

小家电出海同样可以打造DTC品牌。

一方面,产品配合DTC品牌力对外持续曝光、获取流量,积累下全面的消费者行为数据、偏好、人群画像等信息,帮助商家了解目标消费者,使得营销更精准。

另一方面,长期进行DTC品牌运营、积累消费者口碑,塑造消费者认可的品牌,是持续留存回头客和持续吸引新流量的重要途径。DTC品牌力不仅能增加消费者粘性,还能由此为品牌官网独立站降低获客成本、延伸消费者生命周期(LTV)、提升复购率。

总而言之,中国作为世界工厂,这给品牌出海奠定一定坚实基础。

目前国内约有106万家小家电企业注册,但大多数企业主要以ODM(设计制造)、OEM(生产代工)为主。

这就会出现一个问题,出口产品同质化竞争严重,而且缺乏品牌效应。

出海品牌如果不在产品本身和品牌营销方面谋求新出路,等到消费者的新鲜感消散后,出海品牌将会陷入到“有品无牌”的困境。

小家电出海已是大势所趋,如何成就最终的OBM(品牌制造)逆向输出是所有品牌应该思考及探索的问题。